Content Creator

With reforms in policies and a more favourable EoDB rank, India is a lucrative business destination. All eyes are upon this land of unlimited business opportunities and scope. Multiple MNCs are setting up their manufacturing hubs in India at an unprecedented pace. Here are five essentials to know before you start doing business in India.

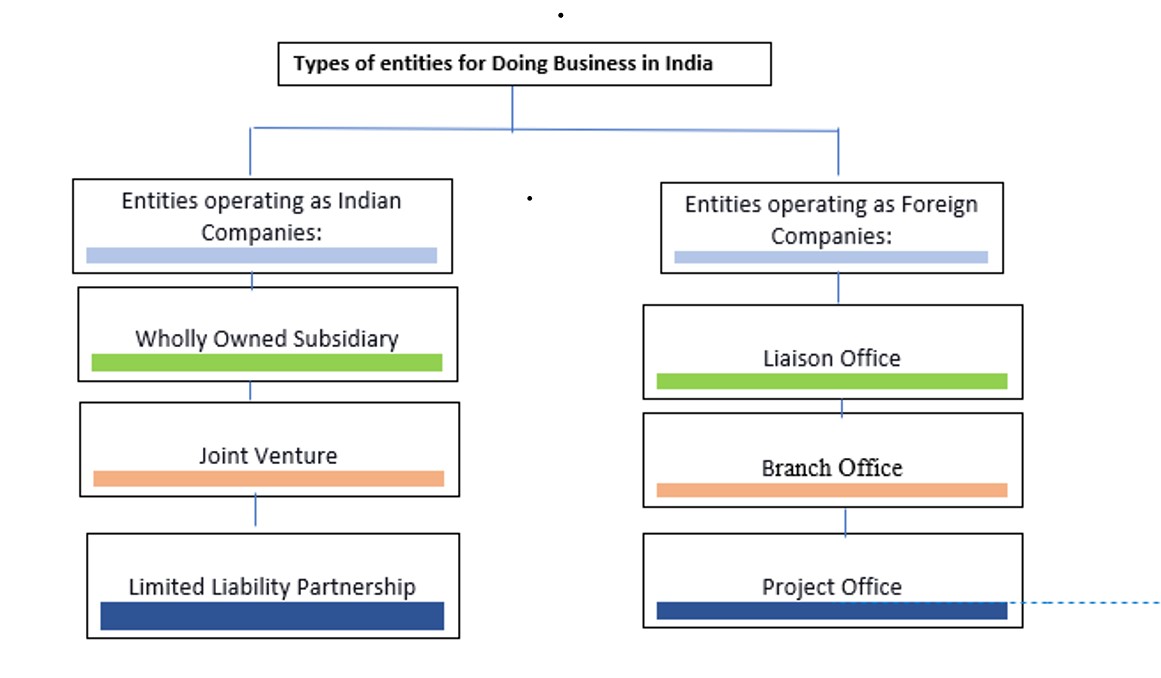

The first and foremost step is to know the type of Entities that can operate in India.

If a company wants to function as an Indian Entity, it can be one of three types.

If a company has its operations as a Foreign Entity, it can function as one of the below:

Liaison Office: that acts merely as a mediator between the parent company and a domestic one

Branch Office: that can facilitate export/import of goods and offer consultancy but no manufacturing activities

Project Office: executes a particular project of a foreign entity assigned by a parent Indian company.

The types of Entities are listed below in the form of Infographics for a better understanding:

Any entity that earns income in India is under the legal obligation to pay Corporate taxes. A foreign company that generates revenue in India is also subject to the same, but the Government has significantly slashed the Corporate Taxation rates for such companies to encourage more FDIs in India.

For existing companies, Corporate Tax decreased to 22% from 30%. For novice manufacturing companies, the tax has been further reduced to 15%.

The Make in India scheme encourages domestic manufacturing and the current high FDI inflow justifies the fact that many foreign companies appreciate this tax reduction.

Similarly, GST, The Goods and Service tax introduced in 2017, replaced several other taxes/duties like CST, VAT, Service Tax, Entry Tax, and Luxury Tax. This reformed tax method simplified tax collection in the country and made it simple for foreign companies to do business in India.

Adherence to Compliance is mandatory for any company operating in India as per the Companies Act 2013. Failure to adhere to this leads to termination of operations and strict legal actions. To prevent such untoward outcomes, every company must appoint periodic audits. Audits can be classified as Statutory and Internal and conducted by Independent Chartered Accountants, a Chartered Accountant Firm, or a Cost accountant. Irrespective of whether it is a Statutory Audit or an Internal audit, it helps to identify procedural and functional loopholes of a company and mitigate them.

India, a country with an extensive workforce, has stringent labour laws to monitor the work culture and employment practices. Failure to comply with these may lead to severe actions by the respective Labour courts as per the jurisdiction. As a foreign company that generates employment for a sizable workforce, it is imperative to be cognizant of the labour laws that are revised from time to time. The dynamic nature of the workforce environment demands reforms and amendments by both the Central and State governments. Under the ambit of proposed labour codes that are yet to be implemented, the law of wages, social security laws, The Occupational Safety laws, the Health and Working Conditions Code, and maternity benefit acts are significant.

Finally, for a business to thrive in India, it must follow a set of systematic mandates. The multi-linguistic population and various dialects in its many cities and districts, calls for a reliable hand holding by expert consultants.

UJA is a leading business consultant with seasoned experts who would offer bespoke solutions and consultancy to every company. The company’s proactive and professional approach leads businesses the correct way.

Get in touch to start your Business journey in this prospective land.