The rapid adoption of new technologies in

According to Invest India, India’s Electric vehicles market is expected to expand at a compounded annual growth rate (CAGR) of 45.5% between 2024-2030, with the segment’s volumes set to cross annual sales of 16 million units by 2030.

Key growth drivers include:

The Government of India has taken initiatives to promote electric vehicle adoption in India. Some of them are:

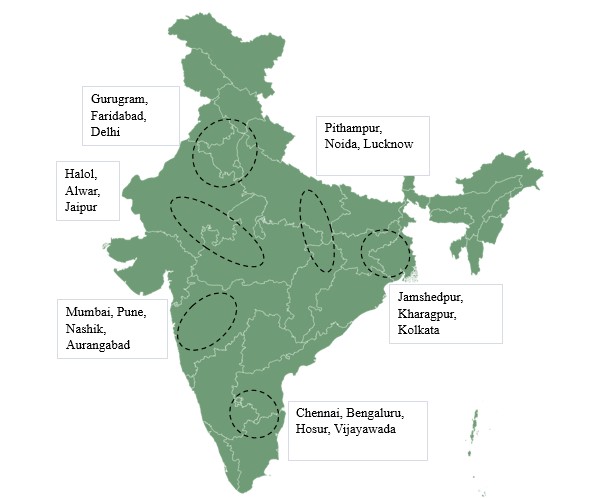

There are huge opportunities for foreign companies in this sector, especially for manufacturing battery compounds, and other components and setting up charging stations.

Company | EV related plans |

Kia | Kia intends to start producing compact SUVs and electric vehicles in India for global markets in 2025 |

Maruti Suzuki | By 2025, Maruti Suzuki intends to introduce its first electric vehicle in India. |

Tata Motors | The government placed an order with Tata Motors for Rs. 5,000 crore for electric buses, and the company intends to introduce 10 additional EVs in India. |

Hopcharge | Hopcharge, a Gurgaon-based start-up, has created the world’s first on-demand doorstep fast charge service |

MG Motors | MG Motors India has partnered with Bharath Petroleum to expand the EV charging infrastructure |

Mahindra & Mahindra | By 2027, Mahindra & Mahindra plans to introduce 16 EV models in its SUV and LCV segments. |

Hero MotoCorp | Hero MotoCorp announced an investment of Rs. 500 crore in California-based Zero Motorcycles to collaborate on the development of electric motorcycles |

MG Motors | MG Motors announced plans to raise Rs. 3,000–4,000 crore in private equity in India to fund its future needs, including EV expansion |

Hyundai Motors Company | Hyundai Plans to invest Rs. 4,000 crore in R&D in India, to launch six EVs by 2028 |